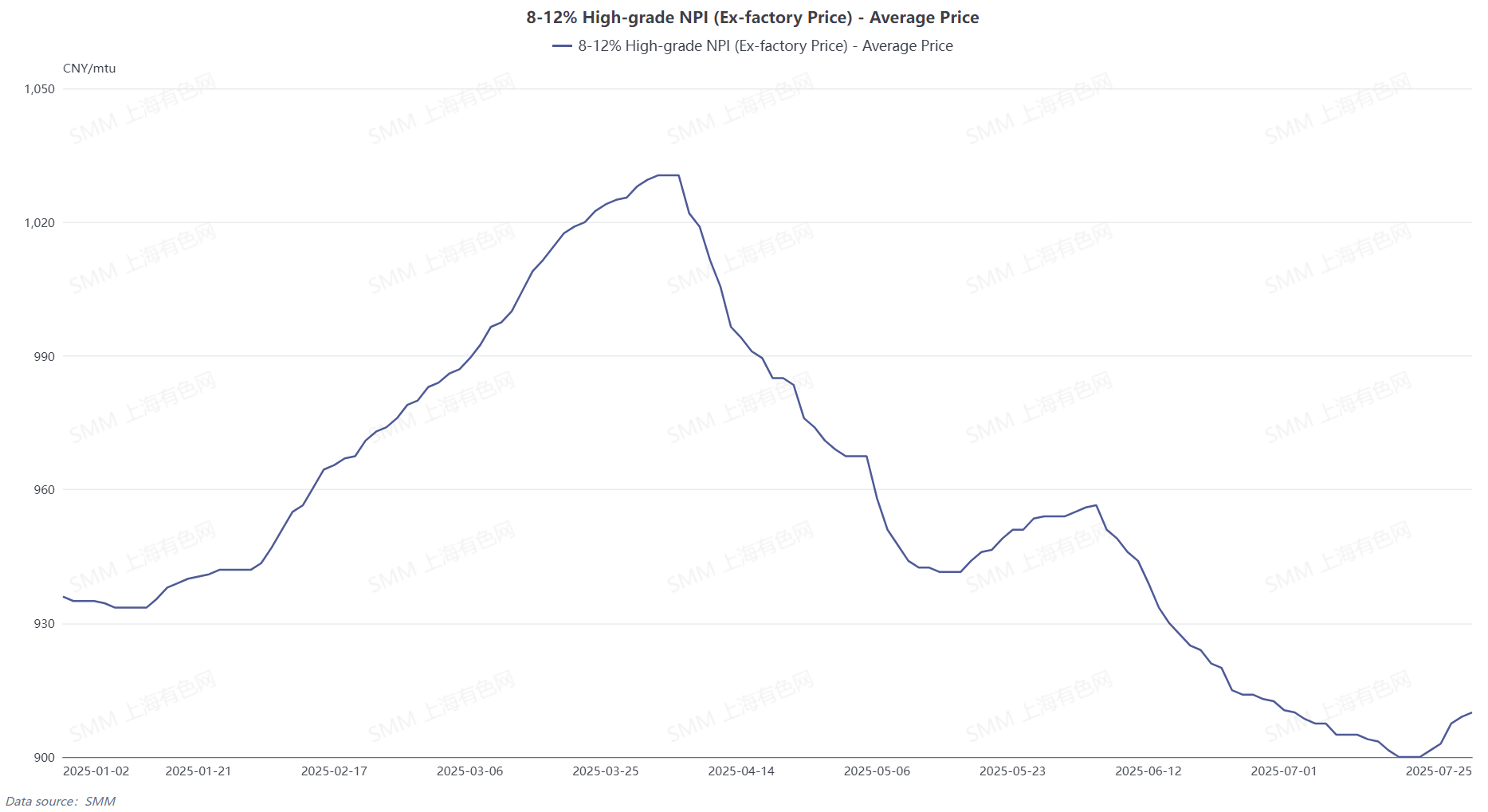

The weekly average price of SMM 8-12% high-grade NPI increased by 5.2 yuan/mtu to 906.2 yuan/mtu (ex-factory, tax included) WoW, while the FOB index price of Indonesian NPI increased by 0.78 $/mtu to 110.64 $/mtu WoW.

The price of high-grade NPI reached an inflection point this week, with increased activity in inquiries and quotations. Supply side, domestically, nickel ore prices in the Philippines eased during the week, but it was difficult to change the current situation of losses for domestic smelters, with smelter production remaining at a low level and holding steady MoM. Meanwhile, due to high costs and stabilized prices, enterprises held back cargoes. In Indonesia, the premium for Indonesian nickel ore eased slightly, but the decline was limited. The cost line for smelters held steady, with losses alleviated but lacking driving force. Some enterprises still faced the expectation of reduced production, and overall production might weaken. Demand side, driven by macro sentiment, stainless steel prices recovered somewhat, providing some support for high-grade NPI prices. Meanwhile, market inquiry activity increased, and transaction prices for traders warmed up slightly. In summary, the pessimistic sentiment for high-grade NPI has improved somewhat recently, and prices are expected to slowly test upward.